- Love and other assets, by Plenty

- Posts

- The five relationship statuses

The five relationship statuses

The five ways couples, couple.

Love & other assets Vol. 5

Hello Plenty Community,

We’re diving into changing dynamics of adult relationships in the U.S.

In 2023, there were almost 5,000 weddings taking place every single day. Despite that, Pew Research Center suggests that there are more adults ‘unpartnered’ now than ever. Adult relationship status now fit into one of five categories: single/unpartnered, living together but not married, married, divorced, and widowed.

In 2019, around four in ten adults aged 25 to 54 (38%) were unpartnered, meaning they were neither married nor living with a partner. This is a jump from the 29% in 1990. Interestingly, there's been a reversal in gender dynamics, with men now surpassing women in the likelihood of being unpartnered – a shift from the scenario 30 years ago.

The solo squad is booming, mainly because fewer folks are putting a ring on it during their prime working years. It’s also more normal to date and live separately for many years. Living with a partner (aka cohabitation) is on the rise, but it's not enough to counter the dip in marriage rates, resulting in an overall dip in partnering up.

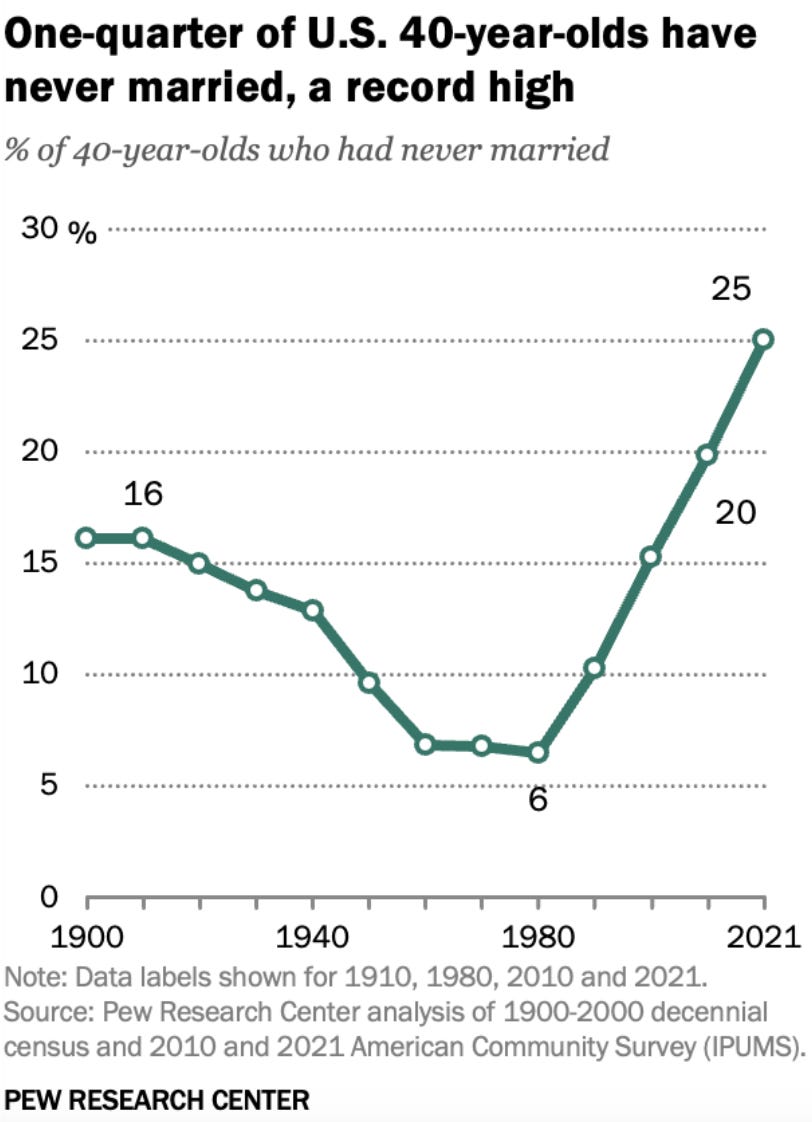

Fast forward to post-pandemic times - our data DeLorean takes us to 2021 and 2022, also courtesy of the Pew Research Center's analysis of the Census Bureau data. Turns out, 25% of 40-year-olds in the U.S. were proudly single, up from 20% in 2010.

Marriage isn’t for everyone. As of 2022, 22% of forever-not-married adults aged 40 to 44 decided to shack up and live together.

Love's got more flavors than ever. Just because couples aren’t married doesn’t mean they aren’t willing to build a life together.

FROM THE PLENTY BLOG

The marriage tax benefit vs. the marriage penalty tax

Maybe more couples are getting married later due to the fear of paying a marriage tax penalty?

With this question in mind, we analyzed the most recent 2024 federal income tax rates applicable to singles, married filers, and heads of households. Afterwards, we talk about which couples might experience a marriage tax benefit and which ones could face a marriage tax penalty upon tying the knot.

Encouragingly, for 99% of couples planning to marry in 2024 and beyond, the prospect of a marriage tax penalty is highly unlikely. This marks a positive shift from the era prior to the passage of the Tax Cuts And Jobs Act in 2017 when more couples found themselves subjected to a marriage tax penalty due to lower income thresholds and higher marginal income tax rates.

For those thinking about marriage and wondering about potential tax implications, here’s a primer to get started.

MORE FROM THE PLENTY BLOG

Night doulas: evening childcare help as an option

Instead of opting for traditional gifts like flowers, chocolates or dinner, consider the gift of time. Providing a babysitter to watch over the kids for a few hours can be a wonderful present, offering your partner and you a chance to unwind.

For partners expecting a child, especially during the challenging "4th trimester" following birth, consider the option of hiring a night doula. This period, spanning three months after childbirth, can be particularly demanding for mothers.

Hormonal fluctuations may lead to postpartum depression, and if the birth involves a cesarean section, a full six weeks of recovery is typically needed. During this crucial time, it's vital to prioritize rest and avoid strenuous activities that could hinder the healing of the incision.

A night doula plays a crucial role in supporting the mother by assisting with feeding, diaper changes, washing baby items, allowing for more sleep, and contributing to a faster recovery.

Hiring a night doula is not cheap. But it might be the best money you’ll ever spend during one of the most difficult times as a parent.

ABOUT PLENTY

Plenty is a wealth platform helping modern couples invest and plan for their future together. We bring the investment strategies and products of the wealthy to the everyday household. For more information, visit withplenty.com. If you ever have any feedback or questions, please do reach out to us at [email protected].

At Plenty, no financial topic is off-limits for modern couples. We offer straight talk and judgment-free guidance to help modern couples navigate the tricky and important intersection of money and relationships. Join thousands of couples who’ve signed up for our free newsletter today.