- Love and other assets, by Plenty

- Posts

- The grasshopper & the ant

The grasshopper & the ant

The ant who dollar cost averages

Love & other assets Vol. 7

Dear Plenty Community,

With the S&P 500 near a record high, investors may be more optimistic than ever. In February 2024, CPI (inflation) rose to a three-month annualized rate of 3.8%, up from 3.0% in October 2023. This exceeds the Fed's long-term inflation target of 2%.

This has resurfaced concerns of a longer period of high interest rates but firms like Goldman Sachs still anticipate rates dropping from June onwards. Only time will tell.

Remember that Aesop’s fable of the grasshopper and the ant? It's good to forage during the summer (ie. in your 30’s and 40’s) like the ants rather than waiting for winter (ie. when you’re close to retirement) like the grasshopper. By the time winter arrives, it might be too late to safeguard your future.

In the near term: if the economy doesn’t recover as expected, be prepared with a robust emergency fund and a diversified portfolio. Planning for alternative income streams (ie. rental income, dividend income, side hustles) also helps protect you. And if the economy continues to grow, then the money you’ve saved up will just work harder for you.

Sincerely,

Emily

FROM THE PLENTY BLOG

Secret ingredients to a happier marriage

In any long-term relationship, be it marriage or a committed partnership, navigating through difficult times is an inherent aspect of the journey. As human beings, we occasionally find ourselves taking the presence and contributions of our loved ones for granted, and with the passage of time, there's a natural tendency to forget to nurture our connections (esp. with kids, busy careers, and aging parents).

But part of a long, happy marriage is finding your way back to each other. It’s okay and normal to drift away at times. This post compiles a few quick tips to get back on track.

Much like the dedication required to stay physically fit, a healthy and thriving marriage needs work, continually improving communication, and a willingness to adapt and grow together.

A strategy to overcome the fear of investing: dollar cost averaging

Investing in stocks, bonds, and real estate can feel like taking a leap of faith, especially since there are no guaranteed returns. For new investors, it’s normal for this uncertainty to lead to fears of losing money, potentially delaying when they begin investing.

Most individuals may choose to stick with what feels “safe,” like a checking or savings account with minimal interest rates. But if it’s just sitting there, it’s both not growing and actually losing value.

If you just want to dip your toes into investing, Plenty’s cash account is invested in government backed treasuries with a 5.07%* yield, thanks to the 11 Fed rate hikes since 2022.

If you’re ready to start investing but want to find the “best” time to start, here’s an important tip: even professional investors have difficulty trying to time the market, so for everyday investors, the stress of timing it may not actually lead to better results. Historical data has suggested that putting a little bit consistently is better than trying to “time” a big investment in one go.

This strategy is called dollar-cost averaging, which allows you to build a portfolio that has taken into account a range of market conditions. To apply it, say you have $25,000 saved up. Instead of investing $25,000 all in one go (the market might have coincidentally had an up or down day), you could invest $5k per month over 5 months. The longer you commit to saving and investing for the future, the more effectively this strategy works.

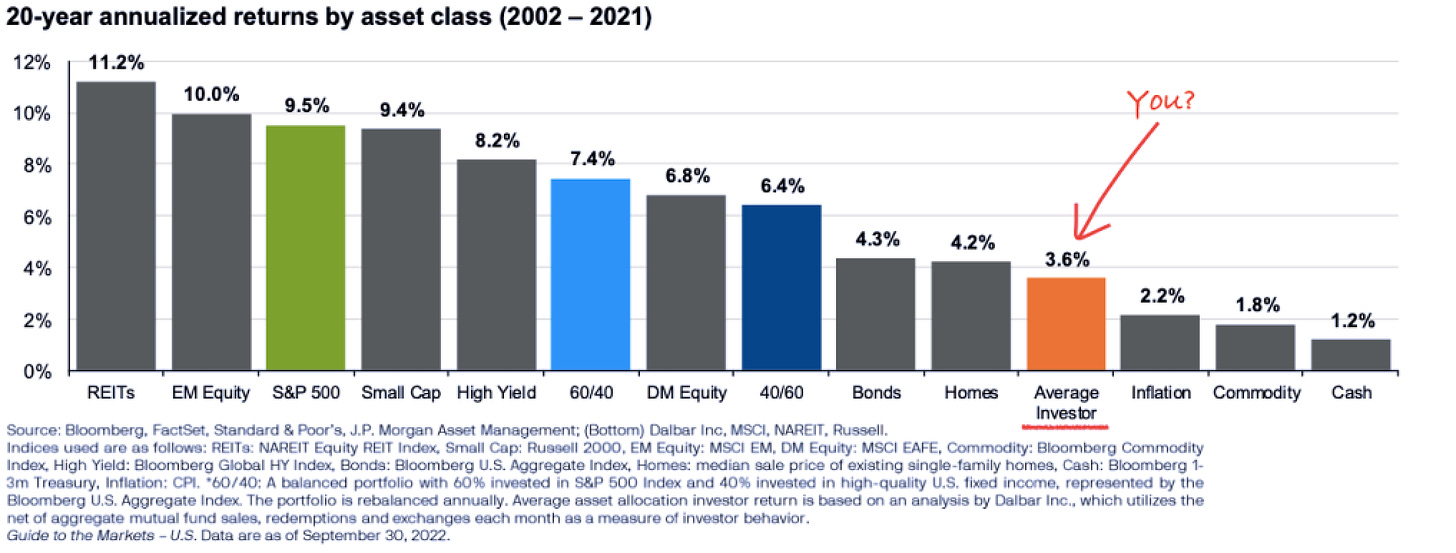

According to the data above, the average investor who tries to time the market has underperformed various asset classes over a 20-year period. Instead, a simpler approach of dollar-cost averaging into an S&P 500 index or your risk asset of choice may produce better results. Although there are no guarantees when it comes to investing, the goal is to remove emotion from investing and regularly invest through the ups and downs over time.

ABOUT PLENTY

Plenty is a wealth platform helping modern couples invest and plan for their future together. We bring the investment strategies and products of the wealthy to the everyday household. For more information, visit withplenty.com. If you ever have any feedback or questions, please do reach out to us at [email protected].

At Plenty, no financial topic is off-limits for modern couples. We offer straight talk and judgment-free guidance to help modern couples navigate the tricky and important intersection of money and relationships. Join thousands of couples who’ve signed up for our free newsletter today.