- Love and other assets, by Plenty

- Posts

- Before they turn 6

Before they turn 6

The experience of a stay-at-home dad

Love & other assets Vol. 6

Hi Plenty Community,

One of the most challenging decisions many parents face is how much to invest in their careers versus dedicating time to their children. Should one parent stay home while the other works? Should both parents continue to work?

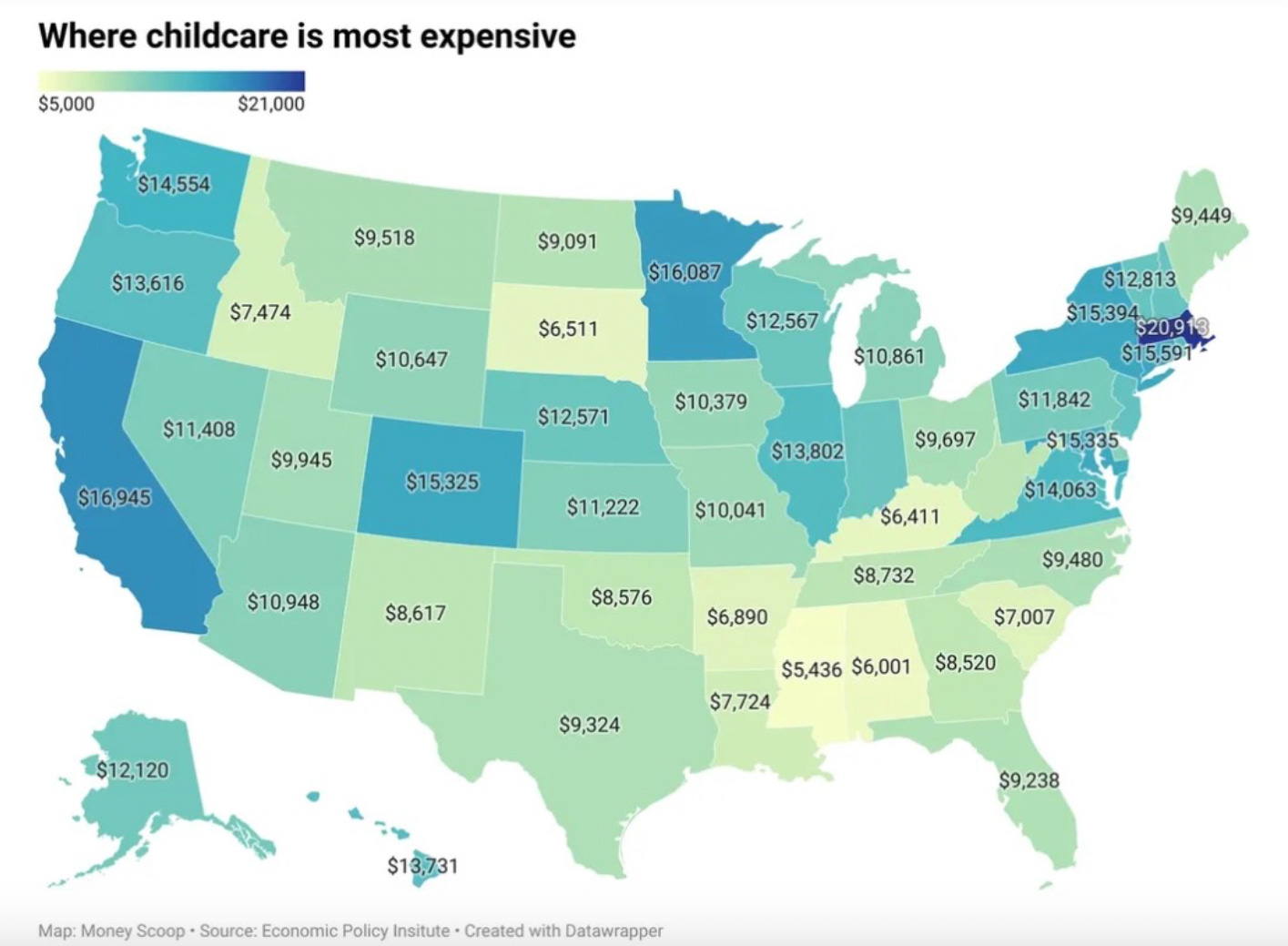

This dilemma is particularly pronounced in high-cost-of-living cities like San Francisco, San Jose, New York, and Los Angeles, where the cost of childcare can sometimes reach up to $30,000 a year after taxes… per kid. Once you’re even 2 kids in, the daycare bills start to throw off even the most career-driven individuals.

There is no right or wrong answer, as every household's financial situation and individual’s needs are different. What's important is having a heart-to-heart discussion with your partner and running the numbers.

For parents contemplating becoming a stay-at-home parent and then eventually returning to work, a couple of important age milestones are 2.5 years and 5 years. By age 2.5, most preschools admit children, and by age 5, kids are often eligible to attend kindergarten full-time.

As a result, you could aim to be a stay-at-home parent for 2.5-3 years or up to 5 years. When your child goes to school full-time, you can then consider returning to work. Of course, if you have more than one child, the decision to resume working becomes more complex.

When it comes to parenthood, there is no amount of planning that is too much. Let’s explore a couple of parenthood dilemmas in today’s newsletter.

Sincerely,

Emily

FROM THE PLENTY BLOG

What it’s like being a stay-at-home dad for 7 years

It's Sam, your friendly newsletter editor. For those considering the stay-at-home parent route, I wanted to share my firsthand experience of being a stay-at-home dad since my son was born in 2017 and daughter in 2019.

When my son was born, I committed to being a stay-at-home dad for five years until he started kindergarten. Given I believe in equality, I made the same decision for my daughter, who will finally be going to school full-time in September 2024.

In a nutshell, my day job in banking working 60 hours a week felt like a stroll on the beach compared to being a stay-at-home dad. For instance, I've encountered whining and screaming at least five times a day for over 2,400 days in a row. Oh, my poor nerves.

However, the experience has also been highly rewarding, witnessing every possible milestone along the way. For both mothers and fathers contemplating taking the plunge, you'll find this post insightful.

How older parents can make up for lost time with their kids

Part of the consequence of inflation and dual-income households is that couples are having children later and later. Consequently, it has become increasingly challenging for some couples to conceive. And if a couple does conceive, they might feel regret for having waited so long.

The good news is that older parents can make up for lost time by spending more time with their children than the average person. The key is knowing what the average amount of time spent is per your demographic and consistently exceeding it over an 18-year period.

In a way, parenting is akin to investing. It involves ups and downs and regrets for actions taken and not taken. However, as long as there is consistent effort and contribution, things usually work out.

ABOUT PLENTY

Plenty is a wealth platform helping modern couples invest and plan for their future together. We bring the investment strategies and products of the wealthy to the everyday household. For more information, visit withplenty.com. If you ever have any feedback or questions, please do reach out to us at [email protected].

At Plenty, no financial topic is off-limits for modern couples. We offer straight talk and judgment-free guidance to help modern couples navigate the tricky and important intersection of money and relationships. Join thousands of couples who’ve signed up for our free newsletter today.