- Love and other assets, by Plenty

- Posts

- Four by four

Four by four

The steady build towards happiness in retirement

Love & other assets Vol. 4

Hello Plenty Community,

The S&P 500 has continued to march higher and reach new all-time highs so far in 2024. For most American households, their investment portfolios are most commonly made up of the trusty four: stocks, bonds, their home, and cash (which are hopefully invested in low risk treasury products that earn at least 5%). For the everyday household, we believe we’re on track for a good year for these trusty four.

Wall Street analysts are sharing their predictions for the S&P 500 this year. And as you read… you’ll see lots of different opinions.

Even highly-paid Wall Street strategists get their predictions wrong all the time. For example, Mike Wilson, a strategist at Morgan Stanley, predicted the S&P 500 would decline to 3,900 in 2023. But the index actually closed up 24% to 4,736.

So word to the wise here, take market forecasts with a grain of salt. When the experts can’t even ‘time the market’, maybe it’s easier and less work to not try and just keep investing steadily.

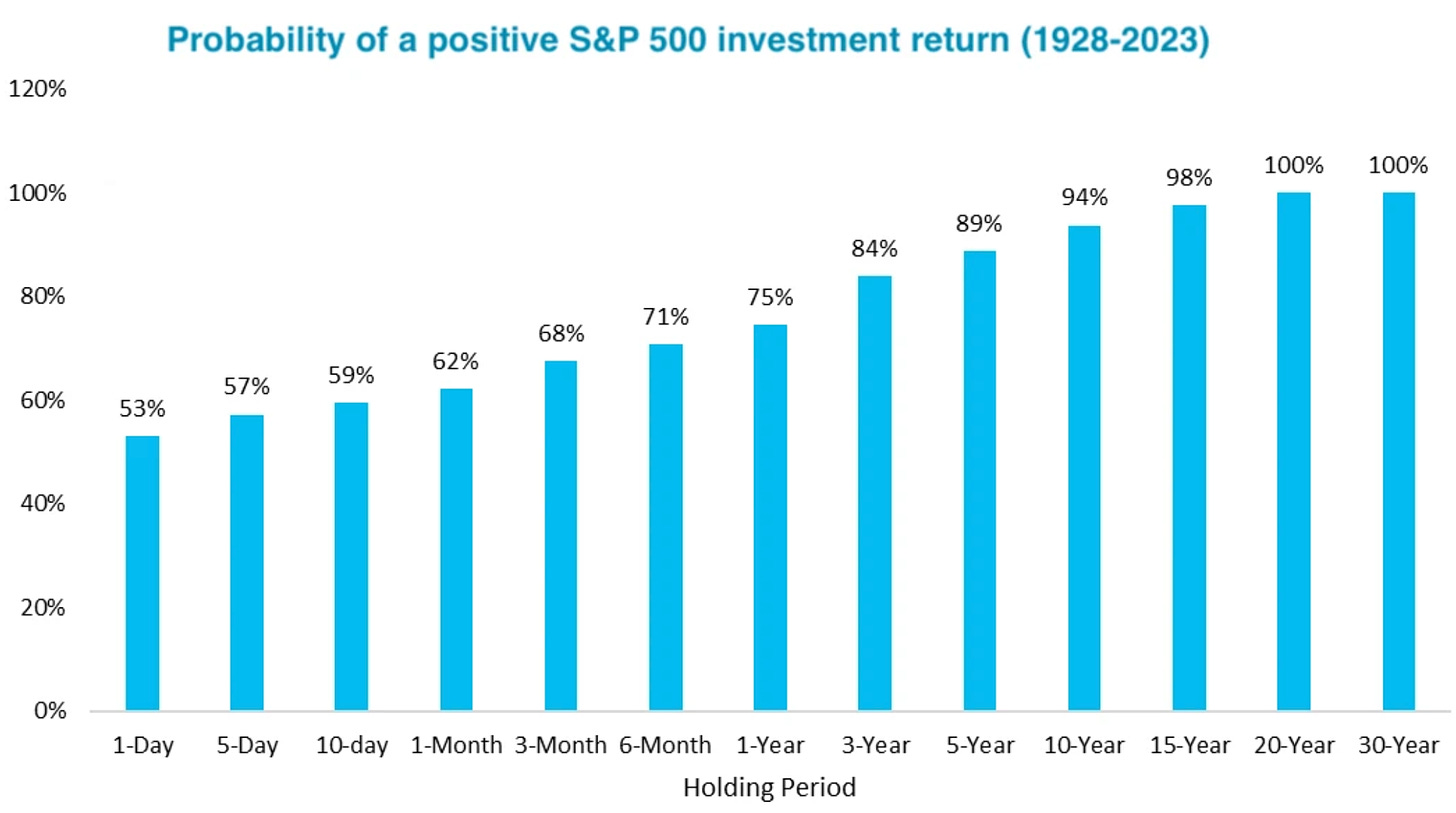

Stock investment returns are never guaranteed, history has shown that the longer we invest in the stock market, the more likely we are to make a positive return.

Below is a great chart by financial planner Charlie Bilello. After investing in the S&P 500 for one year, an investor has a 75% chance of making money. But after investing for 10 years, that probability rises to 94%.

THE HOUSING MARKET

Housing analysts are increasing house value forecasts after only two months

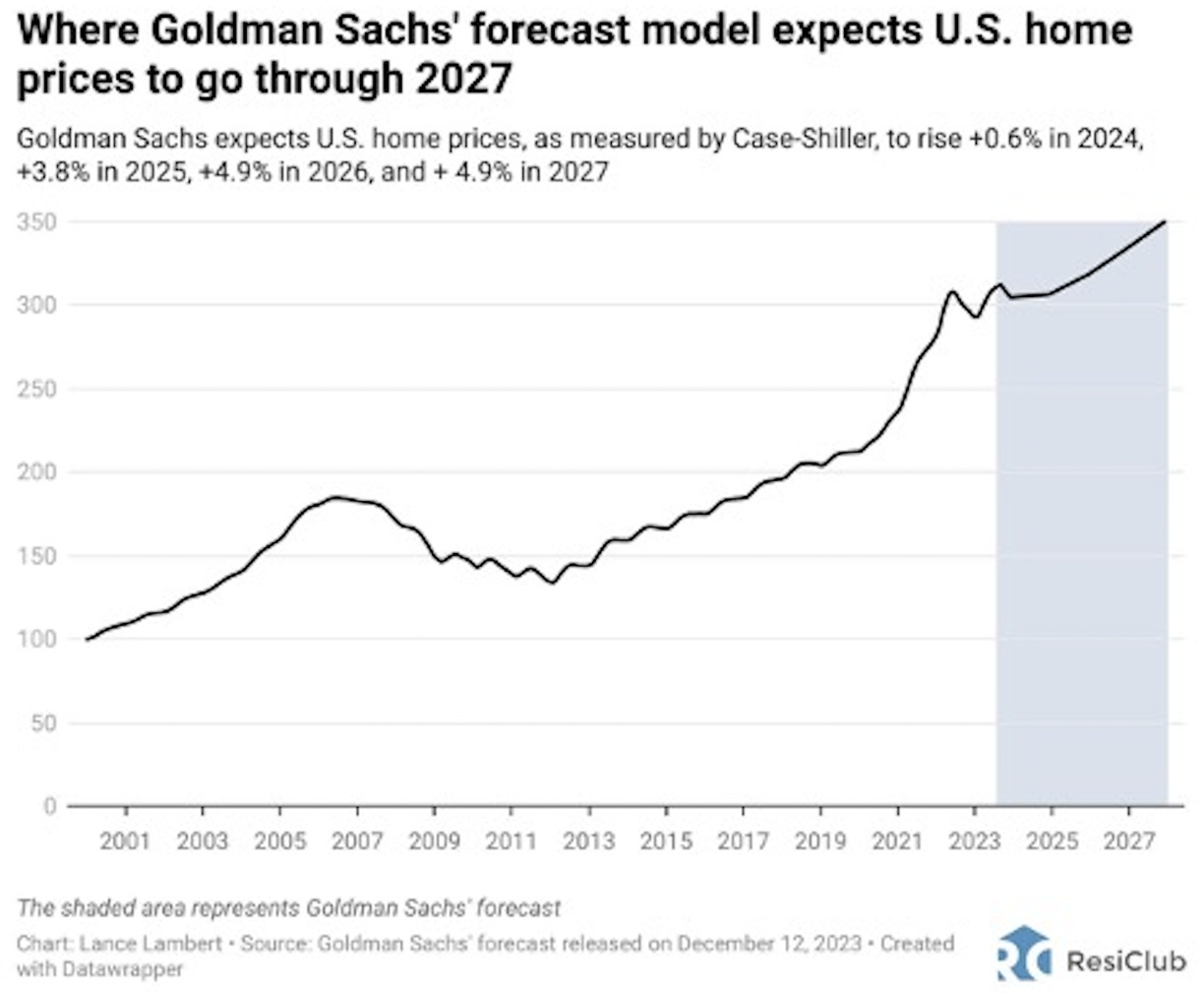

We believe the house values will grow again for homeowners in 2024. In just two months, the average home price prediction for 2024 has gone up from about 1.6% to 2.5%.

Lower mortgage rates are expected to drive pent-up demand to buy, and the positive returns from the stock market will likely also give homebuyers more confidence (and help with the down payments).

We recently heard a story about a family who had a baby at the end of 2019. They were going to buy a house but then the pandemic hit. By the time they were comfortable to bid, home prices had already shot up by 20% or so in 2021, so they decided to wait.

But as they waited, mortgage rates started going up in 2022 after the Fed began its 11-rate-hike cycle. So they decided to wait some more. Now, after almost four more years of saving and investing, they’ve finally decided 2024 is their year to buy a house. Their investment portfolios are at all-time highs, their daughter is now four, and another baby is on the way.

Staying in their affordable two-bedroom, two-bathroom apartment is no longer a desirable option. This is a good reminder that life goes on whether interest rates or home prices cooperate or not. At some point, quality of life becomes harder to put a price tag on.

For a deeper dive into what to expect for home prices in 2024, we also looked around to see what industry experts are predicting.

FROM THE PLENTY BLOG

The key to happiness in retirement is finding where desire and action meet

We stumbled across a fascinating survey by Northwestern Mutual that highlights how much people think they need in retirement by age versus how much they actually have saved for retirement.

One would think that as people get older, they will have narrowed the difference between how much they want versus how much they have. However, paradoxically, there seems to be a lag in steady progress, especially after the survey respondents reached 50.

One of our goals at Plenty is to help ensure couples that no such gap exists. Through regular investing, cash flow management, and staying on top of your finances, we want our users to reach retirement and have exactly, if not more, than what they hoped for.

Before you click over to our post, have a think about how much money you want for retirement. Now compare your desire with how much you have.

ABOUT PLENTY

Plenty is a wealth platform helping modern couples invest and plan for their future together. We bring the investment strategies and products of the wealthy to the everyday household. For more information, visit withplenty.com. If you ever have any feedback or questions, please do reach out to us at [email protected].

At Plenty, no financial topic is off-limits for modern couples. We offer straight talk and judgment-free guidance to help modern couples navigate the tricky and important intersection of money and relationships. Join thousands of couples who’ve signed up for our free newsletter today.