- Love and other assets, by Plenty

- Posts

- One for the money

One for the money

The modern guide to merging finances with your partner

Love & Other Assets Vol. 1

Dear Plenty Community,

Welcome to the inaugural Plenty newsletter. At least twice a month, we’ll share real stories and insights of the highs and lows of joint money management. And we’ll help you answer the common question of: what’s everybody else doing? Our goal is to help couples build trust and confidence around their finances, together.

So sit back, and let us educate, entertain, inform, and encourage more money talks in your household.

Sincerely,

Emily

COUPLES NEWS

Couples miss out when they fail to coordinate retirement benefits

According to MIT Sloan School Of Management, “Better communication between spouses could translate to saving an average of almost $700 more every year for retirement.”

Specifically, Taha Choukhmane, an MIT Sloan assistant professor of finance found that a number of couples didn’t save for retirement effectively and thus missed out on significant financial benefits.

One in four couples could have received an average of $682 more each year through employer matching by coordinating better with their spouse. (The median income for couples in the study was $103,000.)

Even when both partners worked for the same employer, couples didn’t always maximize their contributions efficiently.

Couples with poor indicators of marital commitment (such as those who did not have a joint bank account in the year before marriage or those couples who subsequently divorced) — were less likely to coordinate.

On the positive side, couples who were more “entangled” — such as those who owned a home together or shared children — coordinated better.

Our Thoughts

Having an extra $682 more a year toward retirement savings sounds pretty good to us. Over a 30-year career, we’re talking an extra $81,778 in retirement savings, assuming annual $682 contributions that compound at 7.5%.

With money likely at the top of your mind during this busy holiday season, just think about how many more presents or flights you could buy a year with $682.

Coordinating finances between couples is at the heart of Plenty’s mission. A proper financial plan that is regularly reviewed and discussed by both sides is one of the keys to long-term financial success.

Remember: What gets measured gets optimized.

FROM THE PLENTY BLOG

A modern couple’s guide to merging finances

In the evolving landscape of modern relationships, couples are marrying later mainly due to career focus, leading to a trend of managing finances separately.

In ‘A modern couple’s guide to merging finances’, we explore the old and new ways of having joint accounts, highlighting the symbolic unity and shared responsibility of traditional joint accounts.

Here are three ways modern couples merge or keep their finances separate.

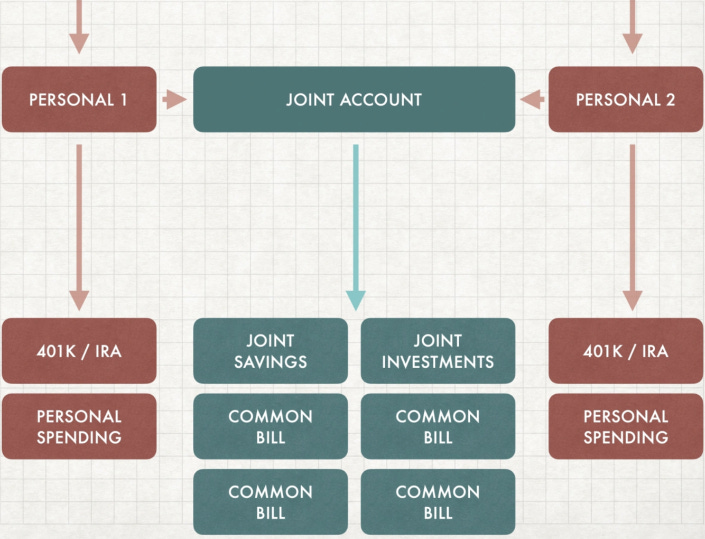

Yours/Mine/Ours: This common hybrid approach involves individual and joint accounts, allowing autonomy and shared visibility.

Join-It-All Approach: This traditional method involves merging all finances, often suitable for single-income households.

What’s Yours-Is-Yours Approach: This approach values complete financial independence, with each partner maintaining separate finances.

Below is an image put together by Adam Nash, Stanford lecturer, the former CEO of Wealthfront, and one of our investors. He uses the image to illustrate how financial planning is fundamentally different for couples today than it was in the past.

Adam writes, “80% of couples are now dual-career and dual-income. Making all of your accounts “joint” is no longer an effective solution, in fact, the most common way dual-income couples manage money is through a “yours/mine/ours” method.”

The key is finding an approach that aligns with your goals and preferences.

ABOUT PLENTY

Plenty is a wealth platform helping modern couples invest and plan for their future together. We bring the investment strategies and products of the wealthy to the everyday household. For more information, visit withplenty.com. If you ever have any feedback or questions, please do reach out to us at [email protected].

At Plenty, no financial topic is off-limits for modern couples. We offer straight talk and judgment-free guidance to help modern couples navigate the tricky and important intersection of money and relationships. Join thousands of couples who’ve signed up for our free newsletter today.